This research is about the business models of Decentralised Finance (DeFi) in Latin America. This is the fourth chapter of my report with the University of Cambridge (Proskalovich et al. 2023). I have given a general overview of this report already, so I am just focusing on the chapter on DeFi here.

DeFi refers to several software solutions that operate on a blockchain. These decentralised systems, supported by blockchain technologies, enable various forms of financial services. DeFi currently operates alongside the traditional financial system, thriving where the traditional system is either inefficient, or expensive, for users. It is unclear whether DeFi and traditional finance will continue in parallel in the future, or merge.

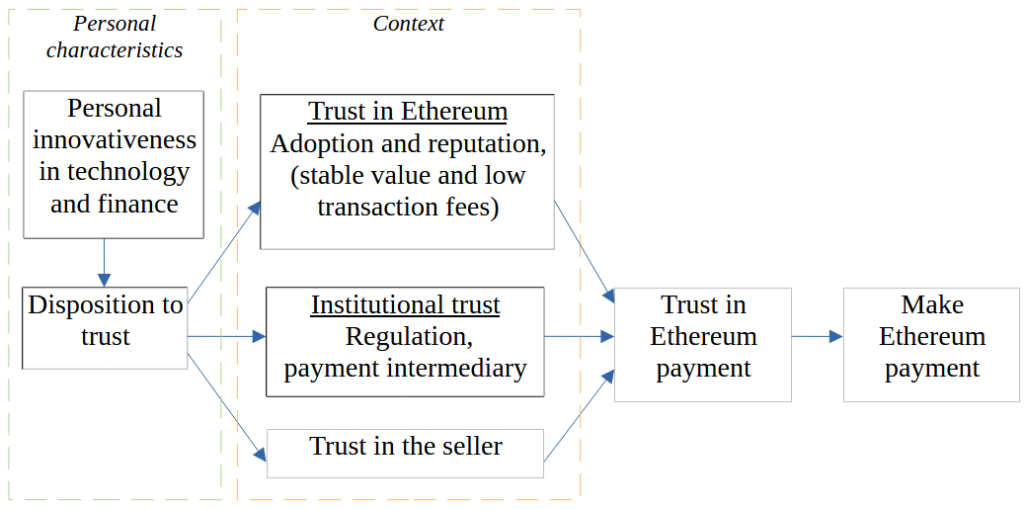

Figure 1. The Decentralised Finance (DeFi) services becoming popular in Latin America

DeFi services

DeFi is constantly evolving, and new use cases will emerge in the coming years. Some use cases of DeFi already identified are decentralised stablecoins, exchanges, lending, derivatives, and asset management.

Payments are an important part of DeFi. Payment can be just with a cryptoassets such as Bitcoin, or they can change bitcoin to a traditional currency and vice versa. Some key areas of the decentralised payments ecosystem are (1) traditional fiat currency-to-crypto services on exchanges, (2) cryptoasset ATMs that exchange traditional currency for cryptoassets and vice versa, (3) cards allowing users to buy and spend cryptoassets, as well as receive them as rewards in loyalty schemes, (4) digital wallets that allow users to send, receive and store cryptoassets, enabling cheaper cross border payments, and (5) both e-commerce and physical shops are increasingly accepting cryptoassets.

DeFi adoption in Latin America

The use DeFi is increasing dramatically, but despite this growth, the activity is very small relative to the use of commercial banks. Digital solutions are vital to overcoming the challenges associated with financial inclusion in Latin America. For example, mobile money use has grown significantly. As cryptoasset adoption in Latin America increases and users become more familiar with the decentralised ecosystem, activity will likely increase. There is a-lot of decentralised financial innovation in the region, such as cryptocurrencies, crypto mining, blockchain and NFTs, with consumers eager to learn more about this ecosystem. So far, Brazil, Argentina and Mexico have the highest adoption of DeFi among Latin American countries.

If you want to learn more about this important part of the cryptoasset ecosystem, you can read the fourth chapter of the report.

Reference

Proskalovich R., Jack C., Zarifis A., Serralde D.M., Vershinina P., Naidoo S., Njoki D., Pernice I., Herrera D. & Sarmiento J. (2023) ‘Cryptoasset ecosystem in Latin America and the Caribbean’, University of Cambridge – Cambridge Center for Alternative Finance (CCAF). Available from: https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/crypotasset-ecosystem-in-latin-america-and-the-caribbean/