Most of us appreciate the importance of Artificial Intelligence (AI) and we know it is bringing big changes. Will we finally have that robot assistant we were promised 50 years ago? Will we even have to work, at least in the sense of how we view work today? It is fun to daydream about these things, but insurers need some certainty on what the future looks like. Some new insurers are trying new business models enthusiastically and then changing direction sharply, like a speedboat swerving to avoid a collision. The larger insurers, however, are like large cruise ships. They need to be able to see far ahead before they plot their course, and they don’t want to keep changing direction.

We wanted to identify the viable AI driven business models to help give some clarity and guidance. Previous efforts had identified four models being applied now, that showed a varying level of enthusiasm for AI. But what about ten years from now? Would there be convergence to one model? If not, what are the key issues stopping this?

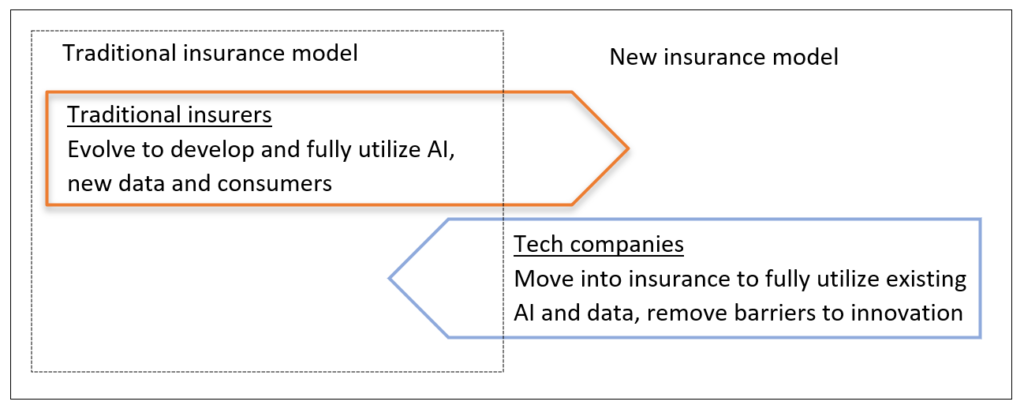

AI is bringing fundamental changes to insurance business models. Those that fail to adapt are likely to disappear. Some traditional insurers are trying to just be more effective with AI, while others reinvent themselves to fully utilize the new capabilities available. Tech-savvy companies from outside the sector like Tesla, are entering and disrupting it. Despite these diverging approaches, there are signs of a convergence towards one, ideal, business model.

Our research focused on one example of a traditional insurer and one new tech-savvy disruptor and evaluated whether their models are converging. We found a high degree of convergence, but some differences are likely to remain even after this transitionary period.

Table 1. Traditional insurers and tech companies AI powered insurance business models

| Difference | Traditional insurer | Tech company offering insurance |

| Service and revenue | Complex and simple service, B2B and B2C Improve customization and interaction | Simple standardised B2C services Revenue not a priority |

| Estimating risk and pay-outs | Information of a high relevance, quality, and reliability | Real time information on behavior Proactively influence behavior and reduce risk |

| Consumer interaction | Several business models in parallel to utilize different technologies Alliance with tech companies to access their user base Better automated interaction | Bundle insurance with existing services, remove the hurdle of insurance for the consumer Use existing access to user data so no additional privacy concerns |

AI is changing the insurance value chain, as illustrated in figure 1. Most new insurers, like Tesla, offer fully automated simple services. The traditional insurers offer some of their simpler services in this way. The more complex services are supported with AI, but a human makes the final decision. An example of this are audits for fraud, where the AI identifies unusual patters and cases for an expert to evaluate.

There are signs of convergence between the models of traditional and new insurers. First, there is convergence in technologies, such as the use of chatbots utilizing AI. Second, there is a convergence in processes, for example, the interaction with the consumer. Third, there is convergence in the strategy on costs and pricing.

However, there are two areas where there seems to be a limit on convergence, which seems to suggest the business models of the incumbent and the disruptor will remain distinct. These are: (1) evaluating risk and (2) the cost of attracting the user and profitability.

Evaluating Risk

AI is changing the way risk is evaluated by an insurer. These new ways of using data and technology to assess risk, in turn generate new insurance services. This is true for new insurers but also some forward-looking traditional insurers. Some existing insurers are creating new services from the new data that is available to them, but they are also creating new services to gain new data.

New insurers like Tesla calculate risk in three ways. First, data is collected from the cameras and sensors in the vehicle providing insight on real time behavior of individuals and groups. Second, a broader analysis of individuals with hundreds of variables is implemented and new algorithms that evaluate risk accurately are improved. Third, the impact on risk of the new technologies is constantly monitored and, in some cases, influenced. For example, software upgrades can be made instantly to all vehicles to improve safety.

Cost of Attracting the User and Profitability

The technology company offering insurance has some advantages in terms of the cost of attracting new consumers and the profits they generate. While the traditional insurer must spend money on marketing to attract consumers to their insurance services, the technology company uses existing consumers. Furthermore, while the traditional insurer is dependent on their revenues from insurance services, the technology company can draw profits from other services and provide insurance without any profit.

Despite some convergence, certain differences are likely to remain even after this transitionary period. This is because the two models have distinct competitive advantages. Traditional insurers no longer monopolize the capability of providing insurance, but they still have the existing user base and utilize it to evaluate risk. Technology-savvy companies that now offer insurance, have their own forms of engagement with their consumers, use different methods to evaluate risk due to their access to real time data, and do not prioritize generating revenue but instead utilize insurance to increase their user base, overcome barriers, and reduce the overall cost of their products and services.

Therefore, when insurers are thinking about how to utilize AI and plot their course through the turbulent, unpredictable times ahead, they should stay true to what they are. This is their comparative advantage.

Dr Alex Zarifis is a lecturer at the University of Nicosia in Cyprus.

This post is adapted from his paper, “Evaluating the New AI and Data Driven Insurance Business Models for Incumbents and Disruptors: Is there Convergence?” available on SSRN.

This article was published on Duke University’s Global Financial Markets Center, a big thank you to Lee Reiners, @leereiners, Kale Wright and Mario Olczykowsky, @m_olczykowski: