New research!

Central Bank Digital Currencies (CBDC) are digital money issued, and backed, by a central bank. Consumer trust can encourage or discourage the adoption of this currency, which is also a payment system and a technology. CBDCs are an important part of the new Fintech solutions disrupting finance, but also more generally society. This research attempts to understand consumer trust in CBDCs so that the development and adoption stages are more effective, and satisfying, for all the stakeholders. This research verified the importance of trust in CBDC adoption, and developed a model of how trust in a CBDC is built (Zarifis & Cheng 2023).

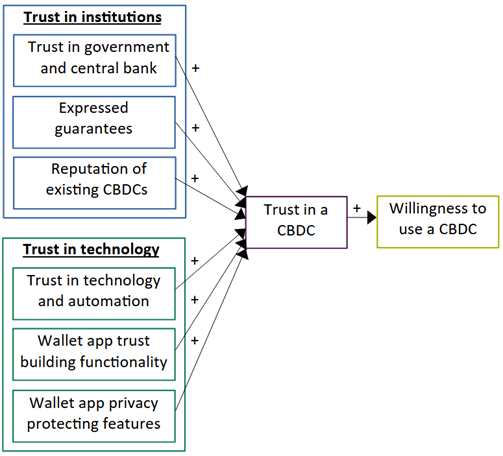

Figure 1. Model of how trust in a Central Bank Digital Currencies (CBDC) is built in six ways

There are six ways to build trust in CBDCs. These are: (1) Trust in government and central bank issuing the CBDC, (2) expressed guarantees for the user, (3) the positive reputation of existing CBDCs active elsewhere, (4) the automation and reduced human involvement achieved by a CBDC technology, (5) the trust building functionality of a CBDC wallet app, and (6) privacy features of the CBDC wallet app and back-end processes such as anonymity. The first three trust building methods relate to trust in the institutions involved, while the final three relate to trust in the technology used. Trust in the technology is like the walls of a new building and institutional trust is like the buttresses that support it.

This research has practical implications for the various stakeholders involved in implementing and operating a CBDC but also the stakeholders in the ecosystem using CBDCs. The stakeholders involved in delivering and operating CBDCs such as governments, central banks, regulators, retail banks and technology providers can apply the six trust building approaches so that the consumer trusts a CBDC and adopts it.

Dr Alex Zarifis

Reference

Zarifis A. & Cheng X. (2023) ‘The six ways to build trust and reduce privacy concern in a Central Bank Digital Currency (CBDC)’. In Zarifis A., Ktoridou D., Efthymiou L. & Cheng X. (ed.) Business digital transformation: Selected cases from industry leaders, London: Palgrave Macmillan, pp.115-138. https://doi.org/10.1007/978-3-031-33665-2_6