Generative AI (GenAI) has seen explosive growth in adoption. However, the consumer’s perspective in its use for financial advice is unclear. As with other technologies that are used in processes that involve risk, trust is one of the challenges that need to be overcome. There are personal information privacy concerns as more information is shared, and the ability to process personal information increases.

While the technology has made a breakthrough in its ability to offer financial insight, there are still challenges from the users’ perspective. Firstly there is a wide variety of different financial questions that are asked by the user. A user’s financial questions may be specific such as ‘does stock X usually give a higher dividend than stock Y’, or vague, such as ‘how can my investments make me happier’. Financial decisions often have far reaching, long term implications.

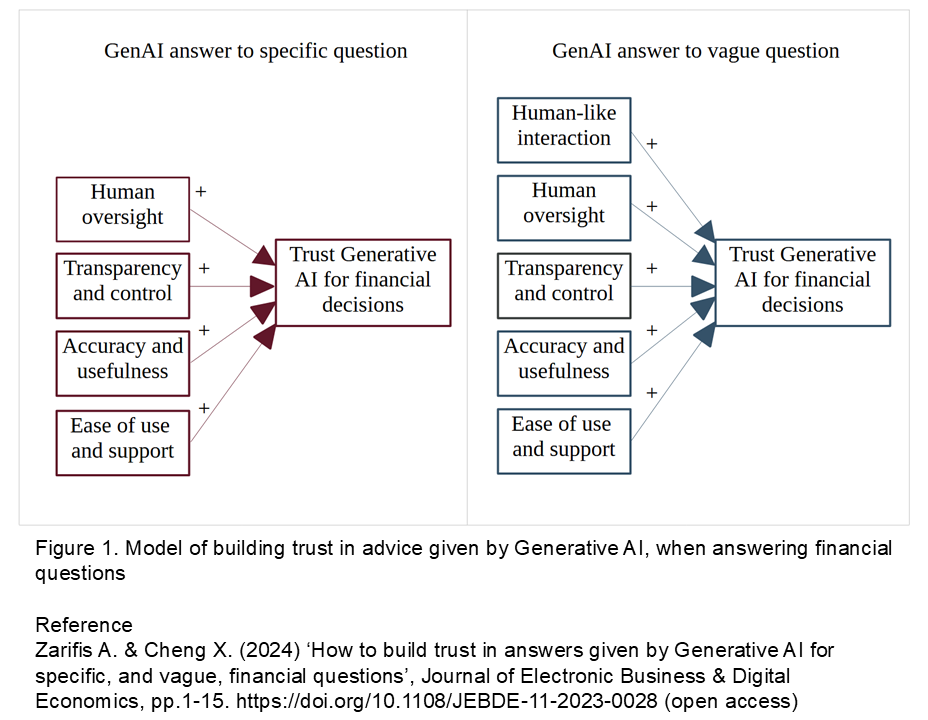

Figure 1. Model of building trust in advise given by Generative AI, when answering financial questions

This research identified four methods to build trust in Generative AI in both of the scenarios, specific and vague financial questions, and one method that only works for vague questions. Humanness has a different effect on trust in the two scenarios. When a question is specific, humanness does not increase trust, while (1) when a question is vague, human-like Generative AI increases trust. The four ways to build trust in both scenarios are: (2) Human oversight and being in the loop, (3) transparency and control, (4) accuracy and usefulness, and finally (5) ease of use and support. For the best results all the methods identified should be used together to build trust. These variables can provide the basis for guidelines to organizations in finance utilizing Generative AI.

A business providing Generative AI for financial decisions must be clear what it is being used for. For example analysing past financial performance to attempt to predict future performance is very different to analysing social media activity. The advise of Generative AI needs to feel like a fully integrated part of the financial community, not just a system. Trust must be built sufficiently to overcome the perceived risk. The findings suggest that the consumer will not follow the ‘pied piper’ blindly, however alluring ‘their song’ of automation and efficiency is.

Reference

Zarifis A. & Cheng X. (2024) ‘How to build trust in answers given by Generative AI for specific, and vague, financial questions’, Journal of Electronic Business & Digital Economics, pp.1-15. https://doi.org/10.1108/JEBDE-11-2023-0028 (open access)