(chapter 4 in book)

Central bank digital currencies (CBDC) have been implemented by some countries and trialled by many more. As the name suggests, the fundamental characteristics are that this is money that is digital, without a physical note or coin, and issued by a central bank.

The consumer has an increasing range of financial services to choose from including decentralised blockchain based cryptocurrencies. A CBDC may use blockchain technology, but it is centralized, so the institutions that support it play an important role. While being centralised may reduce some risks, it may inadvertently increase others. Despite the centralised top-down nature of this financial technology, it still needs to be adopted so the consumer’s perspective, particularly their trust in it, is very important. Each CBDC implementation can be different, and each country’s context can be different, therefore it is important to understand each case separately.

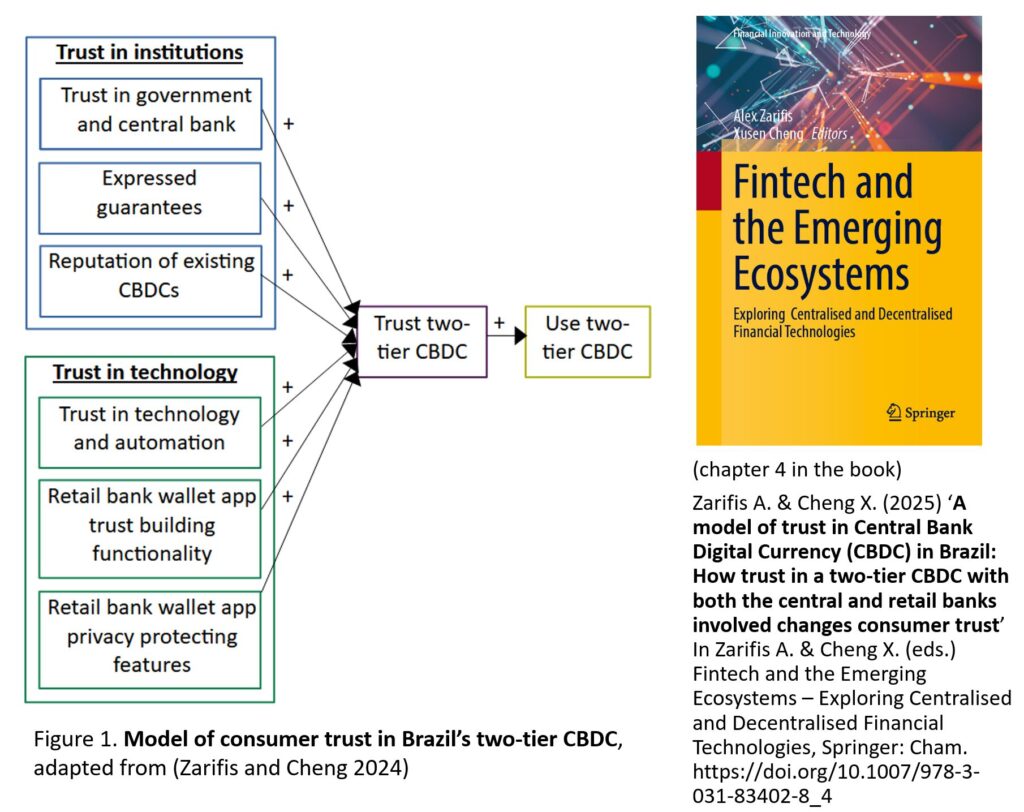

This research models the Brazilian consumer’s trust in their two-tier CBDC, where the central bank and the retail banks retain their current role (Zarifis and Cheng, 2025). This implementation is not a one tier solution where retail banks are bypassed in some ways, and the citizen interacts mostly with the central bank.

Existing research that identified six ways to build trust in a different CBDC (Zarifis and Cheng, 2024) was used as a basis. This research tested a model with one additional way to build trust, but this additional way to build trust was not supported. The seventh hypothesized way that is not supported is that the implementation process, including pilot implementations, would build trust. Therefore, despite the differences in the Brazilian CBDC, the original model applies here also which suggests the model applies for both two-tier solutions, and mixed one and two-tier solutions.

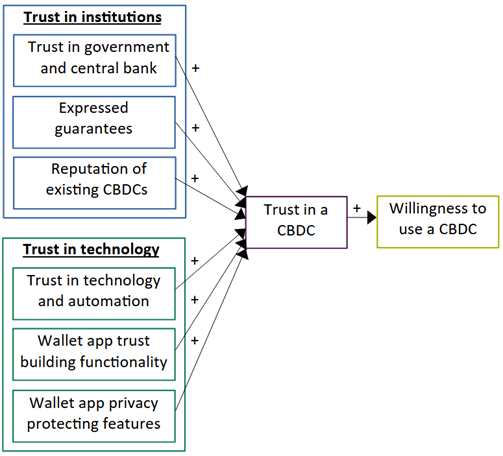

Figure 1. Model of consumer trust in Brazil’s two-tier CBDC, adapted from (Zarifis and Cheng 2024)

Three institutional, and three technological factors, are found to play a role. The six ways to build trust that are supported are: (a) Trust in government and central bank offering the CBDC, (b) expressed guarantees for those using it, (c) the favourable reputation of other active CBDCs, (d) the CBDC technology, the automation and limited human involvement necessary, (e) the trust building features of the CBDC wallet app, and (f) the privacy features of the CBDC wallet app and back-end processes.

It is important to develop user centered services in Brazil so that trust is built in the services themselves, and the government institutions that deliver them, sufficiently for broad adoption.

References

Zarifis A. & Cheng X. (2024) ‘The six ways to build trust and reduce privacy concern in a Central Bank Digital Currency (CBDC)’. In Zarifis A., Ktoridou D., Efthymiou L. & Cheng X. (ed.) Business digital transformation: Selected cases from industry leaders, London: Palgrave Macmillan, pp.115-138. https://doi.org/10.1007/978-3-031-33665-2_6 (open access)

Zarifis A. & Cheng X. (2025) ‘A model of trust in Central Bank Digital Currency (CBDC) in Brazil: How trust in a two-tier CBDC with both the central and retail banks involved changes consumer trust’ In Zarifis A. & Cheng X. (eds.) Fintech and the Emerging Ecosystems – Exploring Centralised and Decentralised Financial Technologies, Springer: Cham. https://doi.org/10.1007/978-3-031-83402-8_4 (open access)