New Fintech and Insurtech services are popular with consumers as they offer convenience, new capabilities and in some cases lower prices. Consumers like these technologies but do they trust them? The role of consumer trust in the adoption of these new technologies is not entirely understood. From the consumer’s perspective, there are some concerns due to the lack of transparency these technologies can have. It is unclear if these systems powered by artificial intelligence (AI) are trusted, and how many interactions with consumers they can replace. There have been several adverts recently that emphasize that their company will not force you to communicate with AI and will provide a real person to communicate with are evidence of some push-back by consumers. Even pioneers of AI like Google are offering more opportunities to talk to a real person an indirect acknowledgment that some people do not trust the technology. Therefore, this research attempts to shed light on the role of trust in Fintech and Insurtech, especially if trust in AI in general and trust in the specific institution play a role (Zarifis & Cheng, 2022).

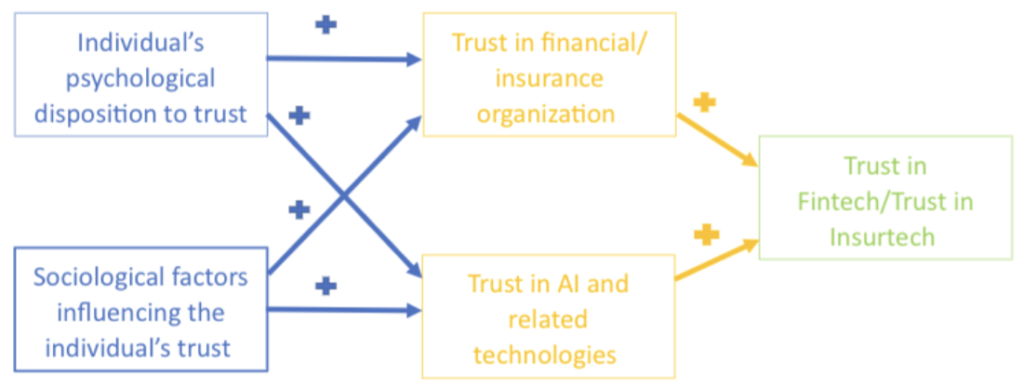

Figure 1. A model of trust in Fintech/Insurtech

This research validates a model, illustrated in figure 1, that identifies the four factors that influence trust in Fintech and Insurtech. As with many other models of human behavior, the starting point is the individual’s psychology and the sociology of their environment. Then, the model separates trust in a specific organization and trust in a specific technology like AI. This is an important distinction: Consumers have beliefs about the organization they bring with them and other pre-existing beliefs on AI. Their beliefs on AI might have been shaped by experiences with other organizations.

Therefore, the validated model shows that trust in Fintech or Insurtech is formed by the (1) individual’s psychological disposition to trust, (2) sociological factors influencing trust, (3) trust in either the financial organization or the insurer and (4) trust in AI and related technologies.

This model was initially tested separately for Fintech and Insurtech. In addition to validating a model for trust in Fintech and Insurtech separately, the two models were compared to see if they are equally valid or different. For example, if one variable is more influential in one of the two models, this would suggest that the model of trust in one of them is not the same as in the other. The results of the multigroup analysis show that the model is indeed equally valid for Fintech and Insurtech. Having a model of trust that is suitable for both Fintech and Insurtech is particularly useful as these services are often offered by the same organization, or even the same mobile application side by side.

Reference

Zarifis A. & Cheng X. (2022) ‘A model of trust in Fintech and trust in Insurtech: How Artificial Intelligence and the context influence it’, Journal of Behavioral and Experimental Finance, vol. 36, pp. 1-20. https://doi.org/10.1016/j.jbef.2022.100739 (open access)

This research was featured by Duke University:

Zarifis A. (2022) ‘Trust in Fintech and trust in Insurtech are influenced by Artificial Intelligence’, Duke University (Global Financial Economics Center). Available from: https://sites.duke.edu/thefinregblog/2022/11/11/trust-in-fintech-and-trust-in-insurtech-are-influenced-by-artificial-intelligence/